Enrollment with Zelle® through Wells Fargo Online® or Wells Fargo Business Online® is required. U.S. checking or savings account required to use Zelle®. Transactions between enrolled users typically occur in minutes. For your protection, Zelle® should only be used for sending money to friends, family, or others you trust. Neither Wells Fargo nor Zelle® offers a protection program for authorized payments made with Zelle®.

The Request feature within Zelle® is only available through Wells Fargo using a smartphone. In order to send payment requests to a U.S. mobile number, the mobile number must already be enrolled with Zelle®. To send or receive money with a small business, both parties must be enrolled with Zelle® directly through their financial institution's online or mobile banking experience. For more information, view the Zelle® Transfer Service Addendum to the Wells Fargo Online Access Agreement. Cross-selling, the practice underpinning the fraud, is the concept of attempting to sell multiple products to consumers.

For instance, a customer with a checking account might be encouraged to take out a mortgage, or set up credit card or online banking account. Success by retail banks was measured in part by the average number of products held by a customer, and Wells Fargo was long considered the most successful cross-seller. Richard Kovacevich, the former CEO of Norwest Corporation and, later, Wells Fargo, allegedly invented the strategy while at Norwest.

Under Kovacevich, Norwest encouraged branch employees to sell at least eight products, in an initiative known as "Going for Gr-Eight". Current Terms and Rates 0.01% APY Having a Way2Save® savings account makes saving an easier and more automatic part of your financial habits. You have to link the account to a Wells Fargo checking account to take advantage of two automatic savings options. Your first option is to use the Save As You Go® transfer program.

Your other option is to set up monthly or daily automatic transfers in amounts of your choice. If you're saving monthly, the deposit has to be at least $25, with the daily minimum set at $1. Transactions typically occur in minutes when the recipient's email address or U.S. mobile number is already enrolled with Zelle®. Available to almost anyone with a U.S.-based bank account. The Request feature within Zelle® is only available through Wells Fargo using a smartphone, and may not be available for use with all small business accounts at this time.

To send money to or receive money from an eligible small business, a consumer must be enrolled with Zelle® through their financial institution. Small businesses are not able to enroll in the Zelle® app, and cannot receive payments from consumers enrolled in the Zelle® app. For more information, view the Zelle® Transfer Service Addendum to Wells Fargo's Online Access Agreement. The other Wells Fargo savings account is Platinum Savings. This account carries a $12 monthly service fee, which is waived by maintaining a $3,500 minimum daily balance each statement period.

Platinum Savings account holders can receive a complimentary debit card, a perk that isn't common with savings accounts. If you overdraw your account, Capital One offers the ability to opt-in to Next Day Grace, which allows the bank to authorize transactions that exceed the balance in your account. You'll have until the end of the next business day to make your balance positive, or you'll incur a $35 fee.

Any bounced paper checks will incur a $9 fee, regardless of overdraft coverage. Wells Fargo also touts the use of your Way2Save account as a method of overdraft protection for customers who also have checking accounts. If you sign up for this optional service, Wells Fargo will transfer money from your Way2Save account into your checking account to cover an overdraft. However, this service doesn't prevent you from being charged a $12.50 overdraft fee once per business day.

The fee can be avoided if a covering transfer or deposit is made on the same business day. Turning off your debit card is not a replacement for reporting your card lost or stolen. Contact us immediately if you believe that unauthorized transactions have been made.

Any digital card numbers linked to the debit card will also be turned off. Availability may be affected by your mobile carrier's coverage area. Other software companies realized that there was potential to become the platform of choice for customers to do their banking. Prodigy, owned by Sears, offered a secure network that Wells Fargo and other banks and businesses allowed to access their own company computer systems.

Customers using the Prodigy service were able to access their bank accounts from the comfort of home for the first time. They could also transfer money, read news, play games, and even order groceries online using the community bulletin feature. Customers had to buy a software package and pay a monthly fee for their software's subscription in addition to any fees charged by their bank. Customers had to use floppy disks and dial up modems to connect to their information. Wells Fargo started offering online account access through Prodigy in 1989, and by the mid-1990s it found that only about 10,000 of its 3.5 million customers used the service.

Turning off your card is not a replacement for reporting your card lost or stolen. Turning your card off will not stop card transactions presented as recurring transactions or the posting of refunds, reversals, or credit adjustments to your account. Any digital card numbers linked to the card will also be turned off. For debit cards, turning off your card will not stop transactions using other cards linked to your deposit account.

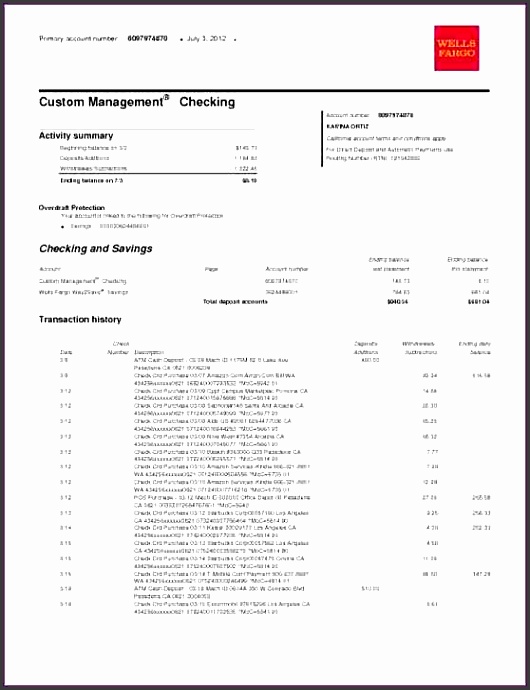

For credit cards, turning off your card will turn off all cards associated with your credit card account. Availability may be affected by your mobile carrier's coverage area. Your mobile carrier's messaging and data rates may apply. Wells Fargo Everyday Checking is Wells Fargo's most popular account for day-to-day banking. The Preferred Checking account can earn you interest if you carry a balance over $500, but said rate hardly stands up to interest-bearing checking accounts from other providers.

The monthly fee can also get in the way of growing your hard-earned cash if you don't qualify for it to be waived. It does come with online account management tools and overdraft protection, but that may not be enough value to balance the potential service fee, longer processing times and limited branch availability. In addition, Wells Fargo automatically waives the monthly fee for account holders under the age of 24.

Key Features Details Minimum Deposit $25 Access to Your Checking Account Online, mobile, over the phone and at physical branches. Security FDIC insurance up to the maximum amount allowed by law. Fees $3 monthly fee, waivable with online-only statements This Teen Checking account is available to teens from 13 to 17 years old. The account will need to have an adult co-owner, although both parties will have equal access to the account. Plus, monitoring the account is made easy for both parents and teens with account alerts, online access and mobile banking.

Parents can set limits on purchases and withdrawals to help their children learn about responsible spending. Account holders will also have access to My Spending Report with Budget Watch which works to help customers develop budgeting skills with free money management tools. The account's perks extend beyond the account itself, too. I overdrafted my Wells Fargo account multiple times after forgetting to transfer a couple of stray recurring bills to my new debit card.

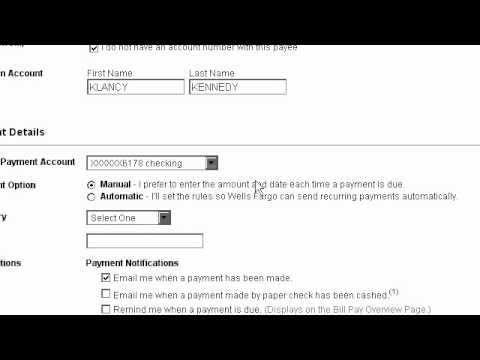

I attempted to set up direct deposit for my paycheck last month, but per company policy I received a physical check in the mail to verify the account switch. When I deposited the check through the Simple app on my phone, Simple said it would take nine business days to clear, making it impossible to pay my rent on the first of the month. Employees also created fraudulent checking and savings accounts, a process that sometimes involved the movement of money out of legitimate accounts.

The creation of these additional products was made possible in part through a process known as "pinning". By setting the client's PIN to "0000", bankers were able to control client accounts and were able to enroll them in programs such as online banking. While 1% is lower than the cash-back rate you'd receive with one of the best credit cards, it's great for debit cards, which typically don't offer rewards programs. Account holders have the ability to redeem cash back as a deposit into a Discover checking, savings or money market account or transfer it to their Discover credit card.

This checking account is for customers with substantially higher account balances. While a high balance isn't required to keep your account, it allows you to earn at a higher interest rate and have the account's high monthly fee waived. Account balances of $250,000 or more also waive fees for incoming wires, stop payments and ExpressSend remittance services, and receive unlimited reimbursement for non-Wells Fargo U.S. ATMs . If applicable on your account, these monthly fees are in addition to your monthly service fee. Wells Fargo provides a pretty well-rounded banking experience for its customers. You have a wide variety of bank accounts to choose from, alongside credit cards, auto loans and more.

So whether you want a simple savings account, a Special CD or a checking account for your teenage daughter, you can find that here. There could be many reasons why you want to close your bank account. It's not uncommon for traditional banks to offer free checking accounts only for you to be slammed with hidden fees later on.

Or for banks to promise high yields on investments and savings accounts, but then you realize the high fees that come with the high yield don't really make it worth it. On the other hand, some banks just make it outright difficult for immigrants. Now you've found a better banking solution and want to get rid of the hassle. The account comes with access to Wells Fargo Mobile app, a debit card with chip technology, budgeting, cash flow and spending tools, online bill pay and 24/7 customer service. Account holders also have access to the Zelle peer-to-peer payment platform. The bank would be difficult for someone in the service industry or other jobs that require depositing cash frequently.

Users who do need to deposit cash can do so by taking it to a bank and getting a money order, which can be deposited by Photo Check Deposit. Simple does not offer personal checks — not an issue for me as I pay my rent online and haven't written a check in several years. OnJuno's FDIC insured High Yield Checking Account can help you earn an industry-leading 1.20% on all deposits.

No more anxiety of switching between checking and savings accounts. So you've made the decision to close your Wells Fargo account. By this point, you've probably realized that their rosy promises of free checking accounts and high-yield savings accounts were just leading you into a labyrinth of hidden fees and charges. And to add insult to injury, an interest rate that hovers between 0 and 0.01%; making you effectively zero income on your precious deposits.

When you bank with Wells Fargo, you'll have access to a ton of features that make banking more convenient. For starters, you'll be able to bank in person at about 13,000 Wells Fargo ATMs and more than 6,000 branches. When you're unable to bank in person, you can use both Wells Fargo Mobile® and Wells Fargo Online® to bank from your home and while on the go. Whether online or in person, you'll be able to send and receive money, pay bills, set up account alerts and more.

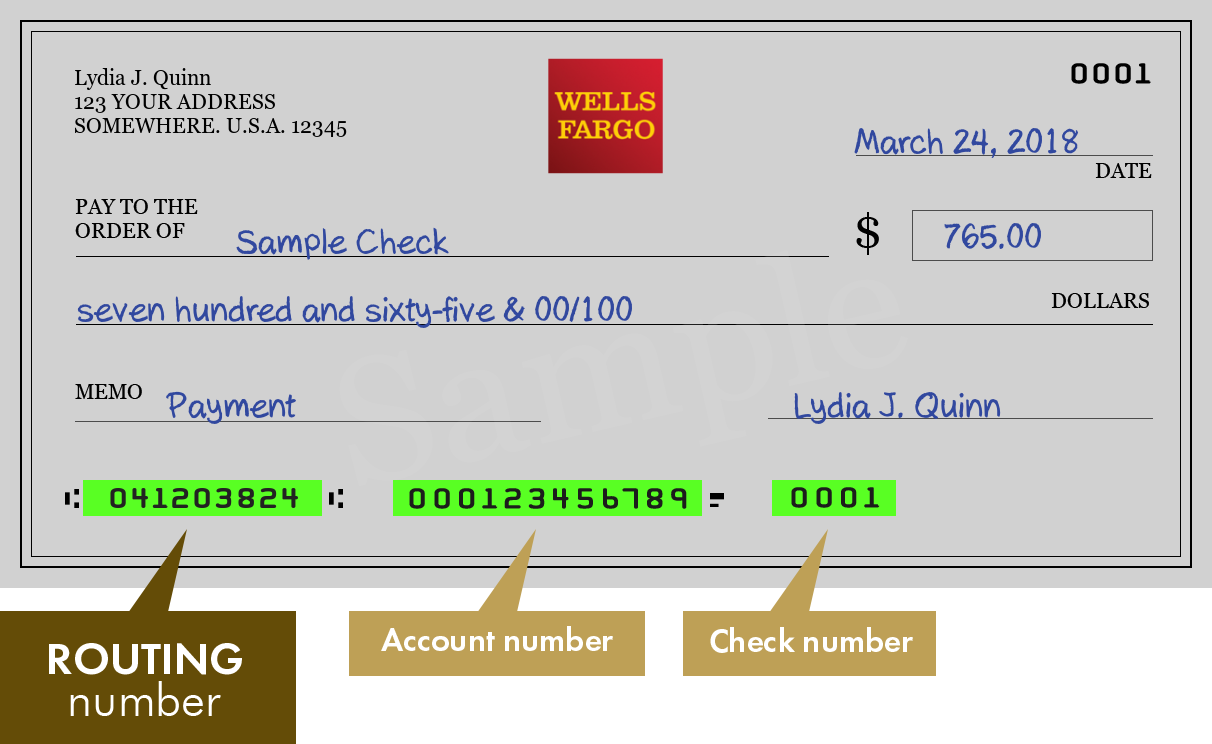

Enrollment in Wells Fargo Online® Wires is required, and terms and conditions apply. Applicable outgoing or incoming wire transfer service fees apply, unless waived by the terms of your account. Wells Fargo Online Wires are unavailable through a tablet device using the Wells Fargo Mobile® app. To send a wire, sign on at wellsfargo.com via your tablet or desktop computer, or sign on to the Wells Fargo Mobile app using your smartphone. For more information, view the Wells Fargo Wire Transfers Terms and Conditions.

Mobile deposit is only available through the Wells Fargo Mobile® app. See Wells Fargo's Online Access Agreement for other terms, conditions, and limitations. Capital One also has a 360 Performance Savings Account that boasts a 0.4% APY.

These rates are far higher than what you can earn with any Wells Fargo product, at any balance. If you're willing to give up banking in person, Capital One's bank accounts may present better value than Wells Fargo. Wells Fargo CDs are savings accounts that pay a fixed interest rate for an agreed upon period of time that the money deposited will stay in the account. By depositing your money into a CD for a set term, you lock in your initial deposit principal and interest rate until your money matures.

Your interest compounds daily and is generally paid monthly, although interest payments made quarterly, semi-annually, annually, or at maturity are also available. There are multiple ways to waive the $10 monthly service fee. The overdraft fee is $35, but you can link to a Wells Fargo savings account for overdraft protection.

You'll still pay $12.50 for transferring funds as overdraft protection, though, so this account is probably the best fit for people who don't expect to overdraw at all. While the Ally Interest Checking Account offers a higher interest rate on balances over $15,000, you're better off putting that money in a high-yield savings account. The Ally Online Savings Account, which is on Select's list of the best high-yield savings accounts, currently offers a 1.00% APY on all balances, which is double the checking account's APY. The Capital One 360 Checking Account takes the number-one spot on our list thanks in part to its top-rated mobile app, physical bank locations and an above-average APY.

National Banking Satisfaction Study, which ranks bank customer experience across various factors, including deposit accounts and convenience. Capital One receives strong satisfaction scores for mobile banking and checking accounts. It has the lowest monthly fee, which you can easily waive by meeting an account requirement. For example, if you use your debit card for at least 10 purchases or payments a month, which is easy with a primary checking account, you can avoid the fee.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.